The Ultimate Guide To Paul B Insurance Medicare Advantage

Table of ContentsUnknown Facts About Paul B Insurance Medicare AdvantageRumored Buzz on Paul B Insurance Medicare Advantage10 Simple Techniques For Paul B Insurance Medicare AdvantageGet This Report on Paul B Insurance Medicare AdvantageThe 15-Second Trick For Paul B Insurance Medicare Advantage

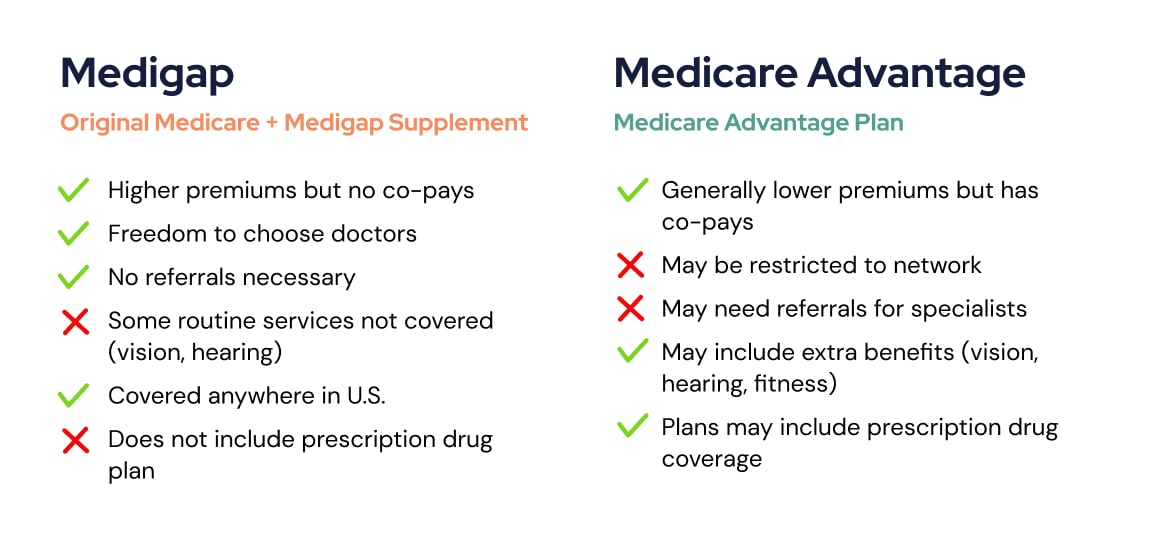

Medicare Advantage Plans can likewise provide extra benefits that Original Medicare does not cover, such as regular vision or dental care. Medicare Benefit expands health care choices for Medicare recipients. Please Keep in mind: If you do not actively pick and enroll in a brand-new plan, you will stay in Original Medicare or the original Medicare managed care plan you currently have.This resembles the Medicare Benefit HMO, other than you can utilize providers outside of the network. You will pay greater deductibles and copayments when you go outside of the network. This is another handled care plan. You do not have to pick a medical care doctor. You can go outside of the network, however you will pay higher deductibles and copayments when you do. This is a managed care strategy with a network of providers. The companies administer the strategy and take the monetary threat. You select a medical care doctor and consent to utilize strategy service providers. This is an insurance coverage strategy, not a managed care plan. The plan, not Medicare, sets the fee schedule for providers, but suppliers can bill up to 15%more.

The Single Strategy To Use For Paul B Insurance Medicare Advantage

All strategies may supply additional benefits or services not covered by Medicare. The Centers for Medicare and Medicaid Services (Medicare.

The Buzz on Paul B Insurance Medicare Advantage

Medicare Advantage Continued plans need to supply all Medicare covered services and are authorized by Medicare. Medicare Benefit strategies might offer some services that Medicare doesn't normally cover, such as routine physicals and foot care, dental care, eye exams, prescriptions, hearing aids, and other preventive services. You would have to find another Medicare Advantage plan or get a Medicare Supplement Policy to go with your Original Medicare.

How Paul B Insurance Medicare Advantage can Save You Time, Stress, and Money.

the HMO network. When you remain within the network, you pay nothing check except the strategy premium and any little copayment amounts predetermined by the HMO.You may likewise select to utilize services outside of the network. When you pick to utilize a service or supplier outside the Expense Contract HMO network, Medicare would still pay their usual share of

the approved quantity - paul b insurance medicare advantage. The Expense Contract HMO would not pay these. Cost Agreement HMOs may register you if you do not have Medicare Part A however have and spend for Medicare Part B. Expense Contract HMOs do not have to enlist you if you have end-stage kidney illness or are already registered in the Medicare hospice program. If you enroll in a private fee-for-service, you can get care from any Medicare physician that consents to the plan's terms, however you need to reside in the plan's service location to be qualified. Medicare pays the strategy a set quantity every month for each recipient registered in the plan. The plan pays providers on a fee-for-service basis.